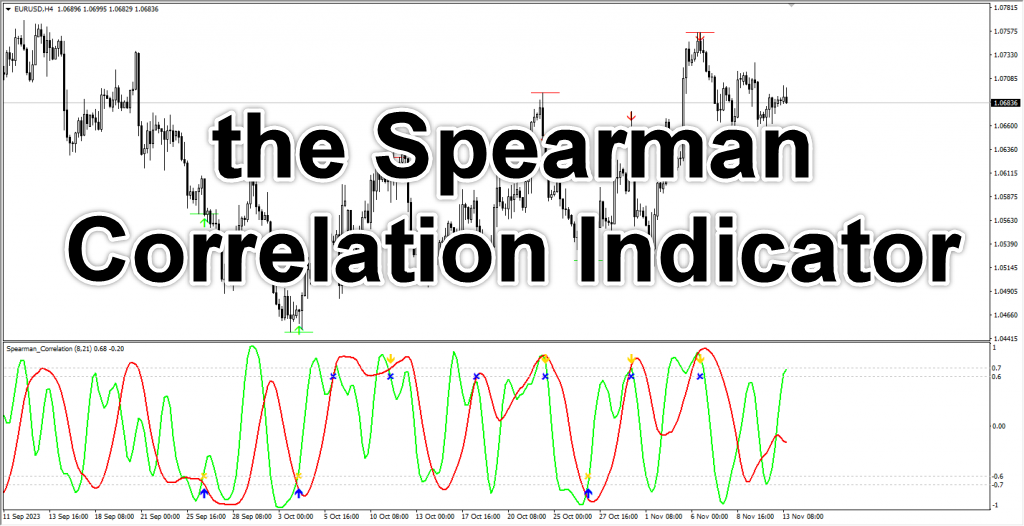

the Spearman Correlation Indicator MT4 MetaTrader for scalp in Forex Free Download

Introduction to the Spearman Correlation Indicator for MT4

The Spearman Correlation Indicator is a trend-following and signal-generating oscillator tool, used widely in both Forex and Stock Market trading. This indicator is based on Spearman’s Rank Correlation Coefficient, a statistical measure used to identify the strength and direction of the relationship between two variables. In trading, this helps identify non-linear correlations between asset pairs and market trends, making it highly useful for Forex traders. It is particularly beneficial for identifying currency pairs that have a low correlation.

The indicator draws two lines on the chart: a green line and a blue line. These lines help visualize the market trend, and when certain conditions are met, the crossing of these lines generates buy or sell signals. One key point to remember when using this indicator is paying attention to overbought and oversold conditions. It is particularly useful in scalping and short-term trading strategies, where quick decisions and precision are crucial.

Premium TradingView account only $20 to buy, click here.

Click here to download and install the Spearman Correlation Indicator .

How to Install the Spearman Correlation Indicator on MT4 📥

To use the Spearman Correlation Indicator on MetaTrader 4 (MT4), follow these steps:

- Download the Indicator: Download the Spearman Correlation Indicator file from the link provided on the website.

- Move to MT4 Directory: Place the downloaded file into the Indicators folder in your MT4 installation directory.

- Restart MT4: After moving the file, restart MetaTrader 4 to refresh the platform and load the new indicator.

- Add the Indicator to Your Chart: Open the Navigator in MT4, find the Spearman Correlation Indicator, and drag it to your active chart.

You can also refer to the installation video guide at the end of the post for step-by-step instructions.

Settings for the Spearman Correlation Indicator MT4 🛠️

Click here to download and install the Spearman Correlation Indicator .

To improve the accuracy of the signals, you can adjust the following parameters in the indicator’s settings:

- PC Period-Fast and PC Period-Slow: These values determine the periods for fast and slow correlation.

- SM Period-Fast and SM Period-Slow: These adjust the smoothing periods.

By default, only the PC Period-Slow needs adjustment. You can set this value to 21 to get optimal results for your trading strategy.

Buy Signal Using Spearman Correlation Indicator 📈

Here’s how you can enter a buy position (Long) using the Spearman Correlation Indicator:

- Increasing Buying Power: A buy signal occurs after the buyers’ strength increases, leading to the formation of bullish candles.

- Oscillator Lines Move Up: During this phase, the green and red lines in the oscillator change direction and begin moving upwards.

- Crossover Confirmation: A buy signal is generated when the green line crosses above the red line.

- Higher Validity in Oversold Area: The buy signal is stronger when the crossover happens in the oversold region.

- Weak Signals Outside Oversold Area: If the crossover occurs outside of the oversold zone, particularly with recent bearish candles, the signal may not be as reliable. It is better to ignore such signals.

- Confirmation with a Bullish Candle: After the crossover, the signal is confirmed when a bullish candle forms, confirming the trend reversal.

- Enter Buy Position: After the bullish candle, or confirmation candle, enters the market and buy the asset.

- Stop Loss: It’s a good idea to place the stop loss near the Swing Low of the previous candle. Alternatively, use the ATR indicator for a more precise stop loss level.

When to Exit a Buy Position?

To exit your buy position, you can set the reward-to-risk ratio between 1.5 and 2. Alternatively, you can exit the position once you see a sell signal or a clear trend reversal.

Sell Signal Using Spearman Correlation Indicator 📉

Click here to download and install the Spearman Correlation Indicator .

Here’s how you can enter a sell position (Short) using the Spearman Correlation Indicator:

- Increasing Selling Power: A sell signal happens after the sellers’ strength increases, leading to the formation of bearish candles.

- Oscillator Lines Move Down: During this phase, the green and red lines in the oscillator change direction and begin moving downwards.

- Crossover Confirmation: A sell signal is generated when the green line crosses below the red line.

- Higher Validity in Overbought Area: The sell signal is stronger when the crossover happens in the overbought region.

- Weak Signals Outside Overbought Area: If the crossover occurs outside of the overbought zone, particularly with recent bullish candles, the signal may not be as reliable. It is better to ignore such signals.

- Confirmation with a Bearish Candle: After the crossover, the signal is confirmed when a bearish candle forms, confirming the trend reversal.

- Enter Sell Position: After the bearish candle, or confirmation candle, enters the market and sell the asset.

- Stop Loss: It’s a good idea to place the stop loss near the Swing High of the previous candle. Alternatively, use the ATR indicator for a more precise stop loss level.

When to Exit a Sell Position?

To exit your sell position, you can set the reward-to-risk ratio between 1.5 and 2. Alternatively, you can exit the position once you see a buy signal or a clear trend reversal.

The Benefits of Using the Spearman Correlation Indicator 🏁

The Spearman Correlation Indicator is a valuable tool for identifying market trends and generating buy and sell signals. Its primary use is to detect trend changes and market fluctuations, making it suitable for short-term and scalping trades. The indicator generates signals based on the crossover of two lines: green and red. By following the rules of signal generation, you can enter well-timed trades and make better decisions based on market conditions. The Spearman Correlation Indicator can be used in different timeframes and combined with other strategies to improve your overall trading performance.

Post Comment