the Raff Channel Indicator MT4 MetaTrader for scalp in Forex Free Download

Introduction to the Raff Channel Indicator for Stock and Forex Markets in MetaTrader 4 📊

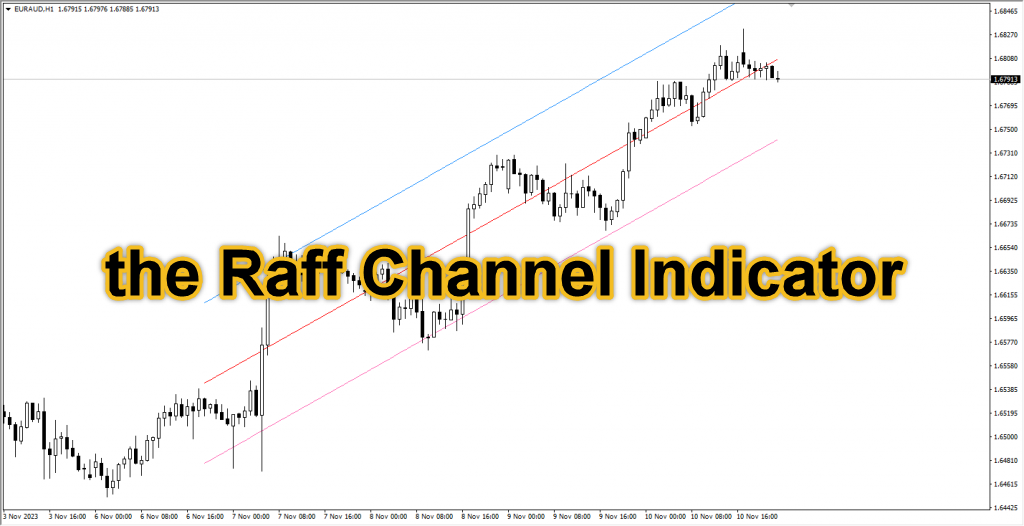

The Raff Channel indicator is a powerful and widely used tool for market trend analysis that helps identify support and resistance levels. This indicator analyzes the price action and marks these levels on the chart, assisting traders in identifying optimal entry and exit points for trades. You can use this indicator for stock and forex markets, and it is adaptable to different timeframes with customizable settings to suit your preferences.

How to Install the Raff Channel Indicator in MetaTrader 4 📥

Premium TradingView account only $20 to buy, click here.

Click here to download and install the Raff Channel Indicator .

Installing the Raff Channel indicator in MetaTrader 4 is straightforward. Follow these steps:

- Download the Indicator: First, download the Raff Channel indicator file from the provided link on the download page.

- Move to MT4 Directory: Transfer the indicator file to the Indicators folder in your MetaTrader 4 installation directory.

- Restart MetaTrader: After transferring the files, close and reopen MetaTrader.

- Add the Indicator to the Chart: After restarting, go to the “Navigator” panel, and drag the Raff Channel indicator onto your chart.

At the end of this post, you will also find instructional videos on installation and setup for further guidance.

Raff Channel Indicator Settings 🛠️

Click here to download and install the Raff Channel Indicator .

By default, the Raff Channel indicator does not require special settings. However, to optimize the performance of the indicator and adjust the range for identifying support and resistance levels, you should modify the Number of Bars setting. This setting determines how many candlesticks the indicator will use to identify trend and support/resistance levels. The higher the number, the larger the range of detection, leading to more accurate identification of support and resistance levels.

Identifying Buy Signals Using the Raff Channel Indicator 📈

Click here to download and install the Raff Channel Indicator .

To enter a long position (buy) using the Raff Channel indicator, follow these steps:

- Identify Support Level: The indicator marks the support and resistance levels. When the price is in a downtrend and reaches the support level, a potential buy signal may occur.

- Bullish Candle Formation: After price hits the support level, if a bullish candle forms and crosses the support level upward, a buy signal is generated.

- Candle Strength: The stronger the candle that crosses the support level upward, the more reliable the buy signal.

- Entering the Buy Position: After seeing the bullish candle that fully crosses the support level upward, you can enter a buy position at the candle’s close price.

- Stop Loss Placement: You can set the stop loss at the previous swing low or the deepest previous trough. Alternatively, you can use the ATR tool to set a more reliable stop loss.

Identifying Sell Signals Using the Raff Channel Indicator 📉

Click here to download and install the Raff Channel Indicator .

To enter a short position (sell) using the Raff Channel indicator, follow these steps:

- Identify Resistance Level: The indicator marks the support and resistance levels. When the price is in an uptrend and reaches the resistance level, a potential sell signal may occur.

- Bearish Candle Formation: After price hits the resistance level, if a bearish candle forms and crosses the resistance level downward, a sell signal is generated.

- Candle Strength: The stronger the candle that crosses the resistance level downward, the more reliable the sell signal.

- Entering the Sell Position: After seeing the bearish candle that fully crosses the resistance level downward, you can enter a sell position at the candle’s close price.

- Stop Loss Placement: You can set the stop loss at the previous swing high or the highest previous peak. Alternatively, you can use the ATR tool for a more precise stop loss.

Risk Management and Exit from Positions ⚖️

Click here to download and install the Raff Channel Indicator .

Risk management and setting exit points are crucial for successful trading. For exiting buy or sell positions, two main approaches exist:

- Reward to Risk Ratio Management: You can set your reward to risk ratio between 1.5 to 2. This means for every 1 unit of risk, expect a reward of at least 1.5 or 2 units.

- Trend Change: If the market trend shifts and you observe the first bearish or bullish candle, you can exit your position.

Other Applications of the Raff Channel Indicator 🔍

The Raff Channel indicator can be used across various timeframes and charts, offering enhanced market trend analysis. It can also be integrated with other compatible indicators, and it is suitable for scalping and medium-term strategies in the forex and stock markets. By using this indicator and adjusting its settings, you can identify more precise entry and exit points and make better trading decisions.

The Raff Channel indicator is an essential and practical tool for identifying market trends and determining support and resistance levels. Using this indicator, you can receive accurate buy and sell signals and make more informed trading decisions. It is adaptable to different timeframes and strategies, helping you trade more accurately.

Post Comment