the FX Snipers T3 CCI Indicator MT4 MetaTrader for scalp in Forex Free Download

Introduction to the FX Snipers T3 CCI Indicator 📊

The FX Snipers T3 CCI indicator is an advanced analytical tool designed to improve the performance of the classic CCI (Commodity Channel Index) indicator. The CCI indicator was first introduced by Donald Lambert, a well-known financial market analyst, and published in the Commodity magazine. This indicator is essentially a technical indicator designed to identify significant and rapid price movements. The FX Snipers T3 CCI indicator is an attempt to optimize and enhance the CCI’s performance, making it a more useful tool for traders.

What is the FX Snipers T3 CCI Indicator? 🤔

Premium TradingView account only $20 to buy, click here.

Click here to download and install The FX Snipers T3 CCI Indicator .

The FX Snipers T3 CCI is a momentum indicator based on the CCI, and it is essentially an optimized version of the CCI. This indicator improves the classic CCI’s fluctuations using more advanced algorithms.

The indicator works as an oscillator and plots histogram bars along with a central zero line on the chart. The histogram bars are displayed in green (for an upward movement) and red (for a downward movement). These features help analysts identify market trends and determine when a trend may change.

The FX Snipers T3 CCI can be used as a trend indicator as well as for identifying trend changes based on changes in the histogram from positive to negative or vice versa. In fact, when the direction of the histogram changes, this can signal a trend reversal. Additionally, this indicator can be used to identify reverse signals created by divergences between price and the indicator.

How Does the FX Snipers T3 CCI Indicator Work? 🧠

This indicator uses a complex algorithm to optimize the CCI’s calculations. The process works as follows:

- First, the typical price (usually the average of the open and close prices) is used as the starting point for the CCI calculation.

- Then, a smoothing factor is applied to the calculations. This factor removes extreme fluctuations and creates a smoother and more accurate line.

- This change results in more precise and reliable histogram bars and lines.

This algorithm enhances the FX Snipers T3 CCI‘s performance compared to the classic CCI, providing more accurate signals for analysts.

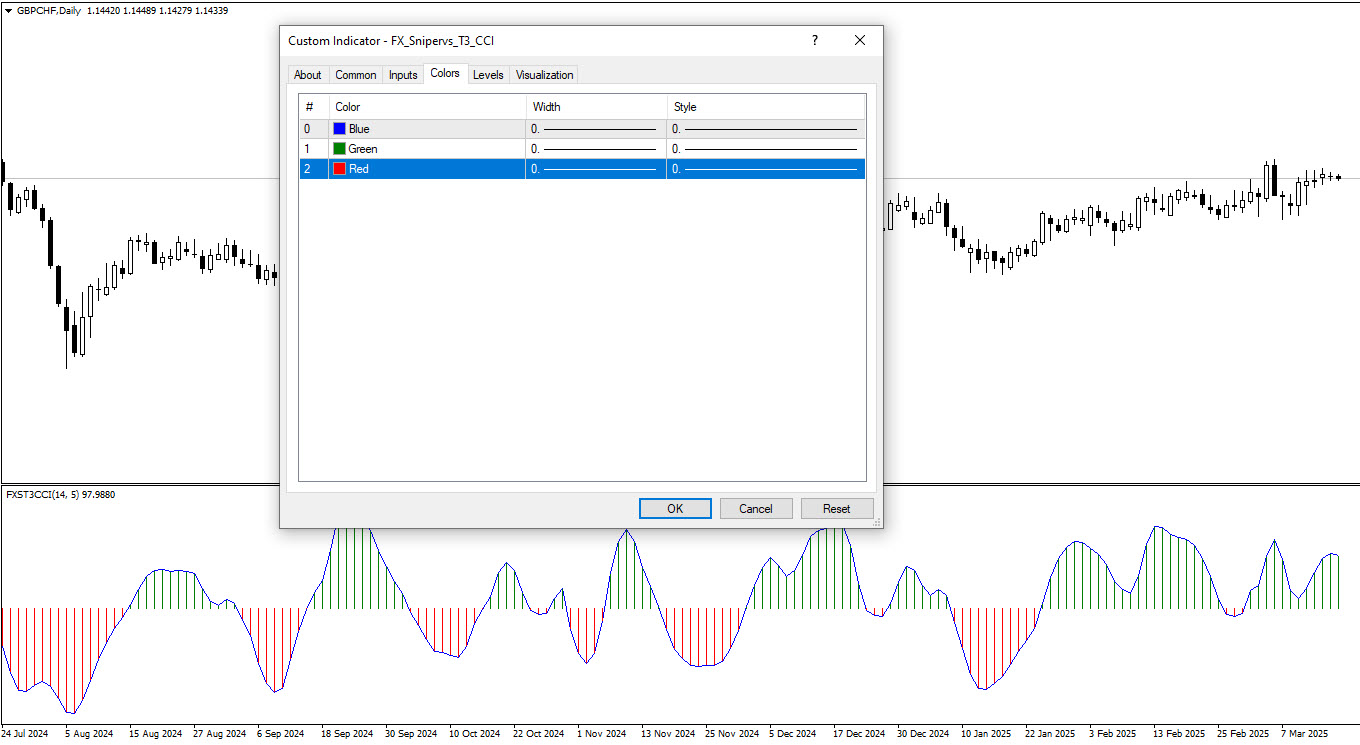

FX Snipers T3 CCI Settings in MT4 ⚙️

Click here to download and install The FX Snipers T3 CCI Indicator .

The FX Snipers T3 CCI indicator in the MT4 platform has three adjustable settings:

- CCI_Period: This refers to the number of periods used to calculate the moving average in the main CCI formula.

- T3_Period: This refers to the number of periods used for smoothing the CCI line.

- b: This is the smoothing coefficient used to enhance the accuracy of the calculations and smooth out the histogram fluctuations.

These three settings allow traders to adjust the indicator according to their specific strategies.

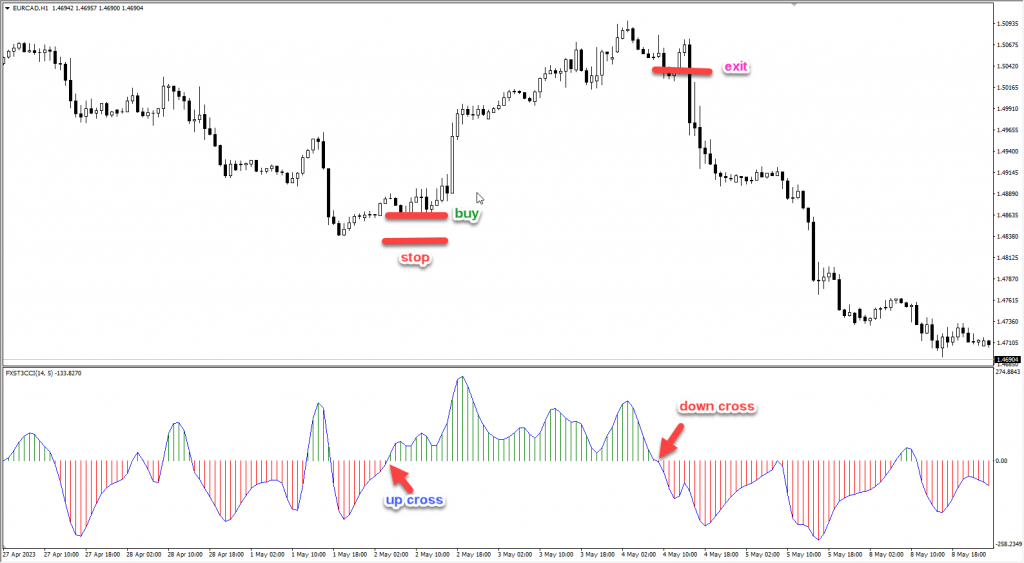

Buy Signals Using FX Snipers T3 CCI 💹

Click here to download and install The FX Snipers T3 CCI Indicator .

When to Enter a Buy Trade?

A buy signal is generated when the histogram bars move from negative to positive or, in other words, cross the zero line upwards. In this case, you can open a buy position and set a stop loss slightly below the indicator’s ATR value.

When to Exit a Buy Trade?

Exit the buy trade when the histogram bars cross the zero line from positive to negative.

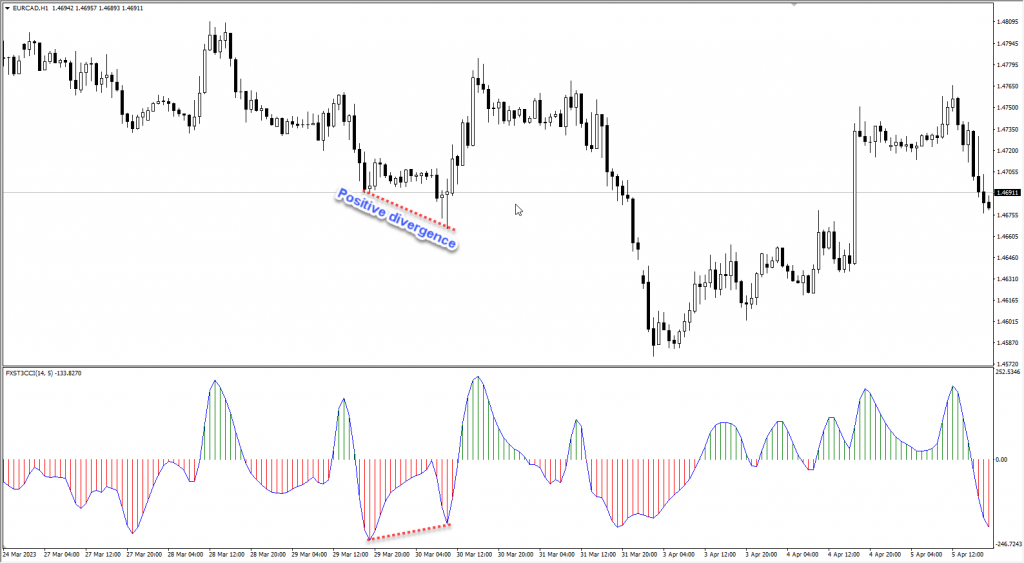

Positive Divergence as a Buy Signal

Positive divergence between the price and the FX Snipers T3 CCI indicator is one of the best ways to receive a buy signal. For example, when positive divergence occurs, the price tends to rise significantly.

Sell Signals Using FX Snipers T3 CCI 📉

Click here to download and install The FX Snipers T3 CCI Indicator .

When to Enter a Sell Trade?

A sell signal is generated when the histogram bars cross the zero line from top to bottom. In this case, open a sell position and set a stop loss slightly above the indicator’s ATR value.

When to Exit a Sell Trade?

Exit the sell trade when the histogram bars cross the zero line from bottom to top.

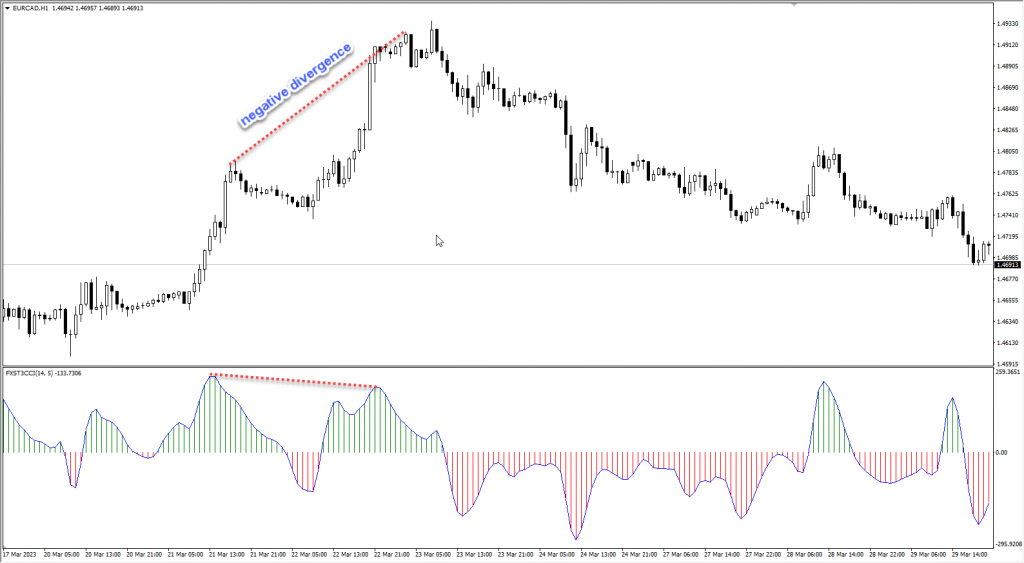

Negative Divergence as a Sell Signal

Negative divergence between the price and the FX Snipers T3 CCI indicator is one of the best ways to identify a sell signal. In this case, the price tends to drop significantly.

Identifying Trend Reversals Using Divergences 🔄

Divergences are one of the main tools in analyzing the FX Snipers T3 CCI indicator. Traders can identify trend changes by recognizing positive or negative divergences between price and the indicator. These divergences help traders make more accurate predictions of market movements.

Using Various Levels in the FX Snipers T3 CCI Indicator 🏆

The FX Snipers T3 CCI indicator is highly flexible and can be customized by adding different levels. These levels can be used to identify overbought or oversold markets. Overall, this indicator works as a versatile oscillator that can be applied in various trading strategies.

The FX Snipers T3 CCI indicator is a powerful and versatile tool that enhances the performance of the classic CCI indicator, allowing analysts to receive more accurate signals for identifying trend changes. The indicator uses green and red histogram bars to make it easier to identify upward and downward trends. Additionally, with the help of divergences and reversal signals, analysts can predict trend changes and enter trades at the right time.

This indicator is suitable for traders at all levels and can be used as a valuable tool in various technical analysis strategies.

Post Comment