Elliott Wave Oscillator Indicators MT5 MetaTrader Free Download

One of the main concerns for market participants is finding the best entry and exit points for stocks. This can usually be achieved by examining various factors such as technical analysis, fundamental analysis, and market psychology. One effective method for identifying suitable entry and exit points is the simultaneous use of multiple indicators. In this article, we introduce the best indicators and how to use them.

Best Indicators for Identifying Entry and Exit Points

For more accurate analysis and stronger signals, a combination of several indicators can be used. Some of the best indicators for this purpose include:

Premium TradingView account only $20 to buy, click here.

-

RSI (Relative Strength Index)

- RSI is one of the most popular indicators for identifying overbought and oversold zones.

- Typically, levels 30 (oversold) and 70 (overbought) are considered key points.

-

MFI (Money Flow Index)

- MFI combines price and trading volume to help identify cash flow into and out of a stock.

- This indicator also has levels 20 (oversold) and 80 (overbought).

-

Stochastic Oscillator

- The Stochastic Oscillator measures the speed and strength of a trend and is very useful in identifying reversal points.

- Levels 20 and 80 indicate oversold and overbought conditions, respectively.

-

MACD Color Histogram

- MACD uses two moving averages to show the strength and direction of a trend.

- Its color histogram helps detect trend changes.

-

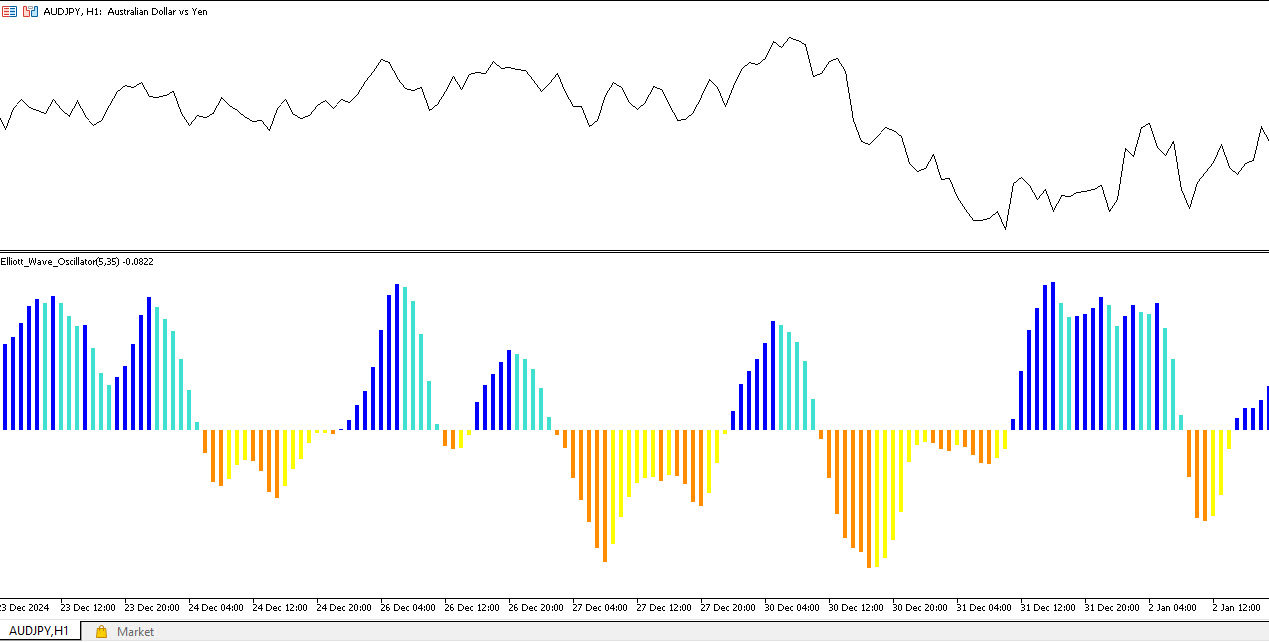

Elliott Wave Oscillator

- This oscillator identifies the phases of Elliott Waves and helps you make better decisions for buying and selling.

What is the Elliott Wave Oscillator?

Click here to download and install the Elliott Wave Oscillator Indicator .

The Elliott Wave Oscillator is a tool that identifies the phases of Elliott Waves for you. By understanding the wave phase, you can make more accurate decisions for buying and selling stocks. This oscillator has two phases: positive and negative.

- Positive Phase: When the oscillator moves from negative to positive, it turns dark blue, and when it moves toward zero, it turns light blue.

- Negative Phase: When the oscillator enters the negative phase, it turns orange, and when it approaches zero, it turns yellow.

How to Use the Elliott Wave Oscillator

To use the Elliott Wave Oscillator, follow these steps:

- Download the Oscillator: You can download the Elliott Wave Oscillator from links.

- Install in Software: After downloading, install the oscillator in your technical analysis software (e.g., MetaTrader).

- Settings: Place the oscillator alongside other indicators like RSI, MFI, and MACD to get the best results.

How to Receive Entry and Exit Signals with the Elliott Wave Oscillator

Click here to download and install the Elliott Wave Oscillator Indicator .

Exit Signal

- When the Elliott Wave Oscillator histogram enters the negative phase (orange), it is a warning to exit the stock.

- For example, in the case of the Wasenat stock, the oscillator changed phase two days before the decline and issued an exit warning.

Entry Signal

- When the Elliott Wave Oscillator histogram enters the positive phase (dark blue), it is a signal to enter the stock.

- In the case of the Wasenat stock, the oscillator issued an entry signal one day before the stock’s rise.

Combining Indicators for Stronger Signals

Click here to download and install the Elliott Wave Oscillator Indicator .

To receive more accurate signals, you can combine indicators. For example:

- RSI + MFI: To confirm overbought and oversold zones.

- MACD + Elliott Wave Oscillator: To identify trend changes and Elliott Wave phases.

- Stochastic + RSI: To identify reversal points.

Key Tips for Using Indicators

- Pay Attention to Support and Resistance Levels: Always analyze support and resistance levels alongside indicators.

- Use Multiple Indicators Simultaneously: Combining indicators increases the accuracy of analysis.

- Risk Management: Even with strong signals, do not forget risk management.

Proper use of indicators such as RSI, MFI, MACD, and Elliott Wave Oscillator can help you identify suitable entry and exit points in the market. By combining these tools and conducting precise analysis, you can make better decisions in your trades. Please share your comments and experiences with us so we can provide more valuable content for you.

Post Comment