Donchian Channels Indicator MT5 MetaTrader for scalp in Forex Free Download.

This guide comprehensively explains how to download, install, configure, and use the Donchian Channels volatility indicator in the MetaTrader 5 trading platform. This powerful indicator is a valuable tool for Forex and stock traders, helping identify trend changes and trading opportunities.

Introduction to the Donchian Channels Indicator

Traders analyze price volatility patterns to predict price direction changes. The Donchian Channels indicator is a momentum tool that identifies trend changes by recognizing previous price volatility breakdowns. It displays the volatility range by drawing channels based on the highest and lowest prices over a specific period. Channel breakdowns can signal trend reversals. Donchian Channels are not only useful for trend detection but also for identifying dynamic support and resistance levels and measuring volatility. This indicator was developed by Richard Donchian, a successful trader. Its core feature is using High and Low prices in calculations, setting it apart from other channel indicators like Bollinger Bands.

Premium TradingView account only $20 to buy, click here.

Click here to download and install Donchian Channels Indicator.

How to Download and Install the Donchian Channels Indicator

To download the Donchian Channels indicator for MetaTrader 5 for free, search reputable online sources. Use search terms like “Donchian Channels MT5 indicator free download” in search engines. Always use trusted and known sources to ensure system security. Avoid downloading files from unknown or suspicious sources. After downloading the indicator file (usually with a .ex5 or .mq5 extension), copy it to the MQL5\Indicators folder in your MetaTrader 5 installation directory. Restart MetaTrader 5; the indicator will appear in the indicators list.

How the Donchian Channels Indicator Works

Donchian Channels draw channels by calculating the highest and lowest prices over a specified period. By default, this period is 20 periods (but is adjustable). The upper channel line shows the highest price during this period, and the lower line shows the lowest price. The distance between the upper and lower lines represents the price volatility range.A unique feature of Donchian Channels is the forward shift of the channel lines. This shift (defaulting to 2 periods) provides clearer signals and prevents signal delays. This ensures signals react quickly to price changes, identifying trading opportunities sooner.

Click here to download and install Donchian Channels Indicator.

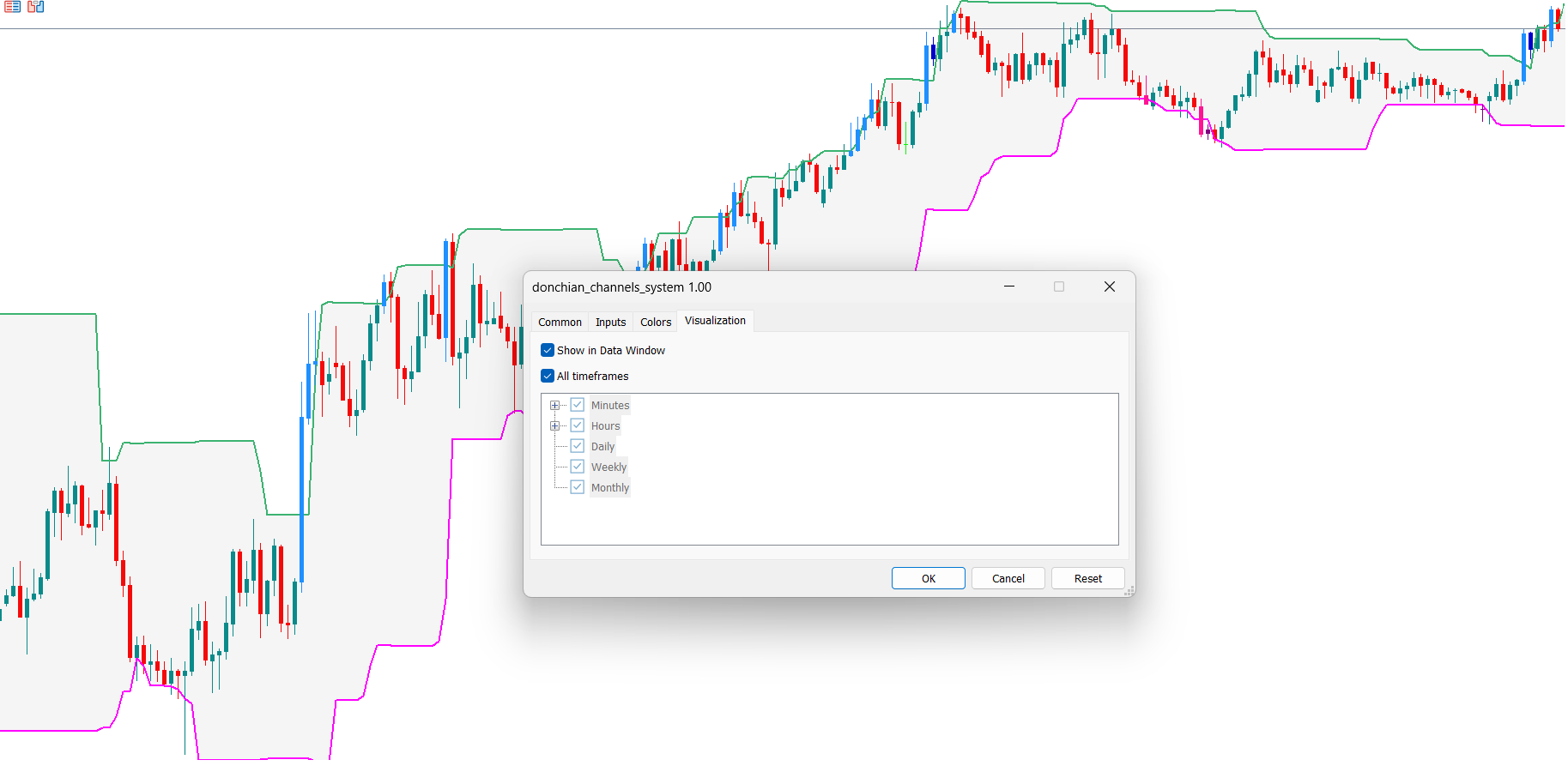

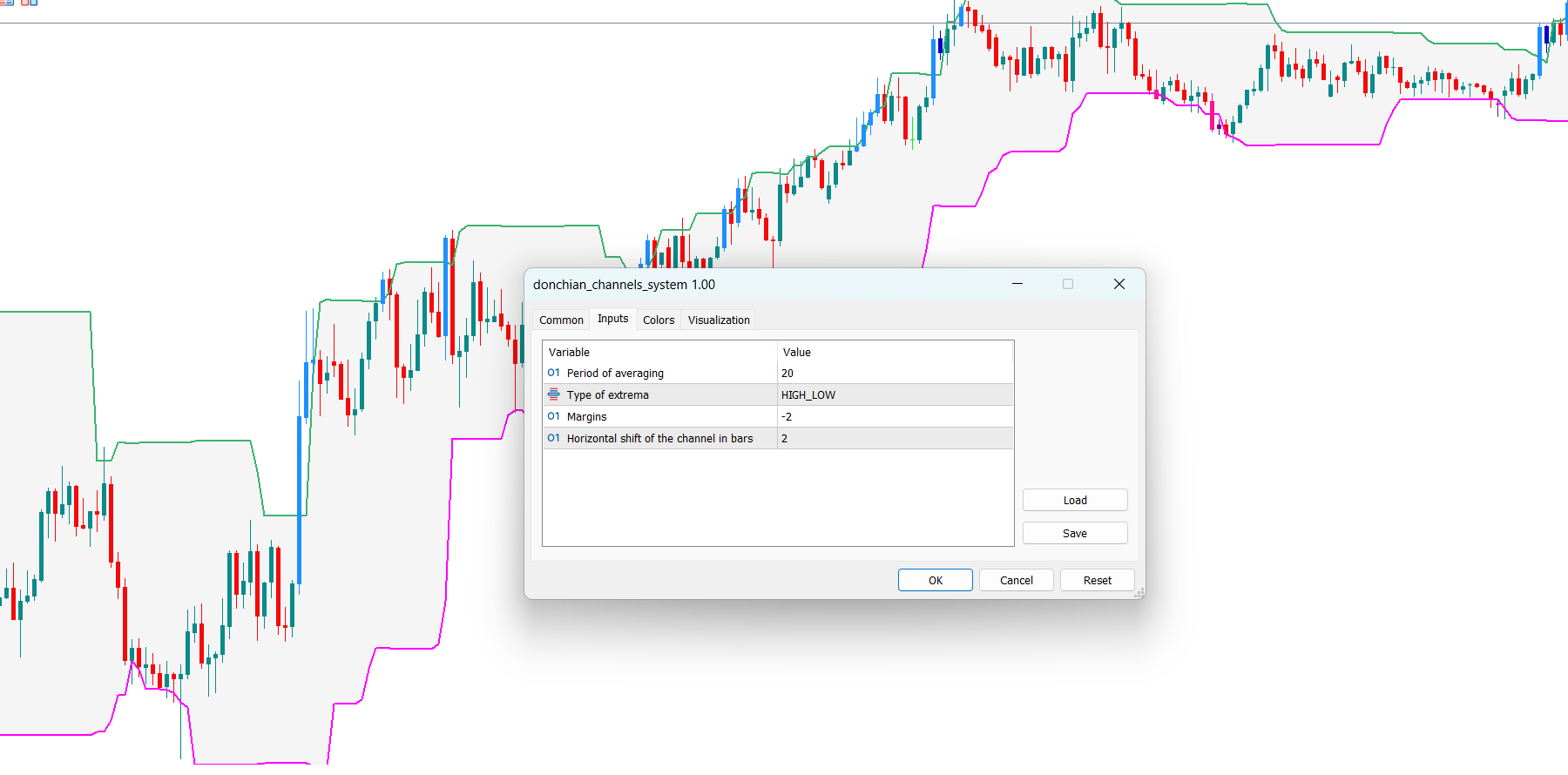

Donchian Channels Indicator Settings

The Donchian Channels indicator has several adjustable parameters affecting its performance:

-

Period: The number of periods used to calculate the highest and lowest prices. Increasing this value reduces indicator sensitivity, producing fewer signals, but these signals are usually more accurate. Decreasing this value increases sensitivity, generating more signals, which may include more false signals. Common values range from 10 to 50.

-

Type of extreme: The price types used to calculate the channel. High and Low prices are typically used. Using the Close price can yield different results. The best price type depends on your trading style and the market.

-

Shift: The number of periods the channel lines are shifted forward. This directly impacts signal timing. A larger shift gives earlier but potentially less accurate signals. Shift values typically range from 0 to 5.

-

Applied Price: The selected price for Donchian channel calculation. High, Low, Open, Close, or Median Price can be used.

Click here to download and install Donchian Channels Indicator.

Trading Strategies Using the Donchian Channels Indicator

Several trading strategies utilize Donchian Channels:

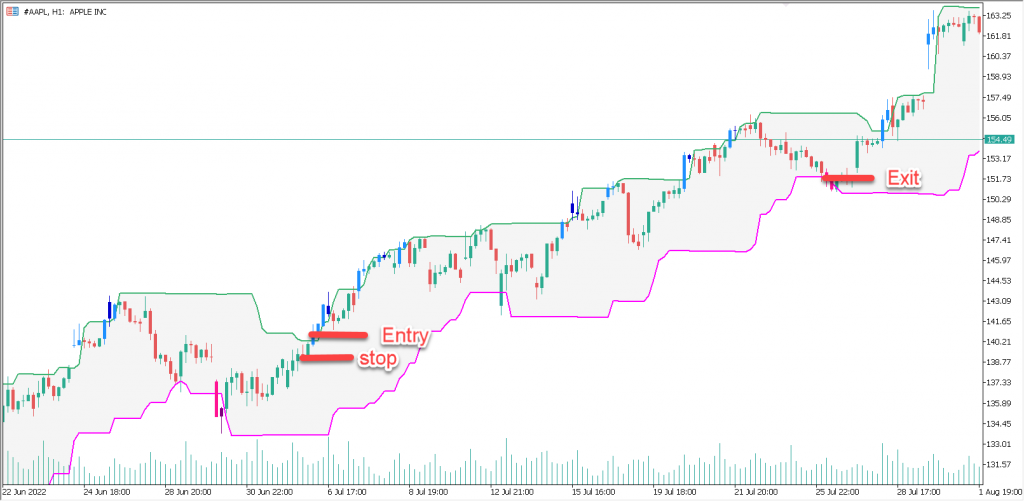

a) Breakout Strategy:

In this strategy, buy trades are entered when the price breaks above the upper channel line, and sell trades are entered when the price breaks below the lower channel line. To reduce false signals, wait for the candle to fully break through the channel line and close. Using confirmations from other indicators (like trading volume or moving averages) is helpful. Place the stop-loss slightly beyond the channel line and set the take-profit appropriately (e.g., using a risk-reward ratio).

b) Trend Following Strategy:

This strategy uses Donchian Channels to confirm the overall market trend. If the price is above a long-term moving average (like SMA 200) and breaks above the upper channel line, it’s a strong buy signal. Conversely, if the price is below the long-term moving average and breaks below the lower channel line, it’s a strong sell signal. Combining this with trend indicators like MACD or RSI can increase accuracy.

c) Combining Donchian Channels with Other Indicators:

Using Donchian Channels alone is not recommended. Combining it with other indicators like RSI, MACD, moving averages, Stochastic RSI, or candlestick analysis provides more accurate and reliable signals. For example, RSI confirms trend strength, and moving averages confirm trend direction.

Click here to download and install Donchian Channels Indicator.

Risk Management and Trading Psychology

Success in Forex and stock trading heavily relies on risk management and emotional control:

-

Position Sizing: Always determine your position size based on risk management. Use the following formula:

(Capital * Risk Percentage) / (Stop Loss - Entry Point) -

Portfolio Diversification: Spread your capital across multiple currency pairs or stocks to reduce risk.

-

Emotional Control: Don’t let fear or greed influence trading decisions. Stick to your strategy and maintain trading discipline. Backtesting and thorough past analysis help make more rational decisions.

-

Trading Journal: Record all trades with details (entry point, exit, stop-loss, take-profit, reason for entry and exit, timeframe, and currency pair). This helps learn from mistakes and improve your strategy.

Buy Signal:

-

When a candle breaks below the lower channel line and moves upward, it indicates a bearish trend breakdown. Confirming this signal with other indicators is crucial.

Click here to download and install Donchian Channels Indicator.

Sell Signal:

-

When a candle breaks above the upper channel line and moves downward, it indicates a bullish trend breakdown. Confirming this signal with other indicators is also essential.

Click here to download and install Donchian Channels Indicator.

Choosing Timeframes and Currency Pairs

Choosing appropriate timeframes and currency pairs for using Donchian Channels is essential:

-

Timeframes: Short-term timeframes (M5, M15, H1) are suitable for day trading and scalping. Mid-term timeframes (H4, D1) are suitable for swing trading. Long-term timeframes (W1, MN) are suitable for long-term trading. The suitable timeframe depends on your strategy and risk tolerance.

-

Currency Pairs: Volatile currency pairs like EUR/USD, GBP/USD, USD/JPY, AUD/USD are better suited for Donchian Channels. However, this doesn’t mean it’s ineffective for less volatile pairs. The most important thing is matching your strategy with the characteristics of the chosen currency pair.

-

Avoiding Trades During News Releases: Avoid trading during significant economic news releases, as market volatility increases, raising the risk of stop-loss triggers.

Final Notes

No indicator guarantees profitability. Donchian Channels are just a tool for finding trading opportunities. Continuous learning and proper risk management are essential for trading success.Optimizing Donchian Channels parameters based on market conditions and your trading style is crucial.Continuously learn and expand your knowledge of technical analysis and risk management.This guide provides a starting point for learning and using Donchian Channels. With practice and experience, you can improve your skills and use this indicator effectively in your trading.

Post Comment