i-High Low IndicatorMT5 MetaTrader for scalp in Forex Free Download

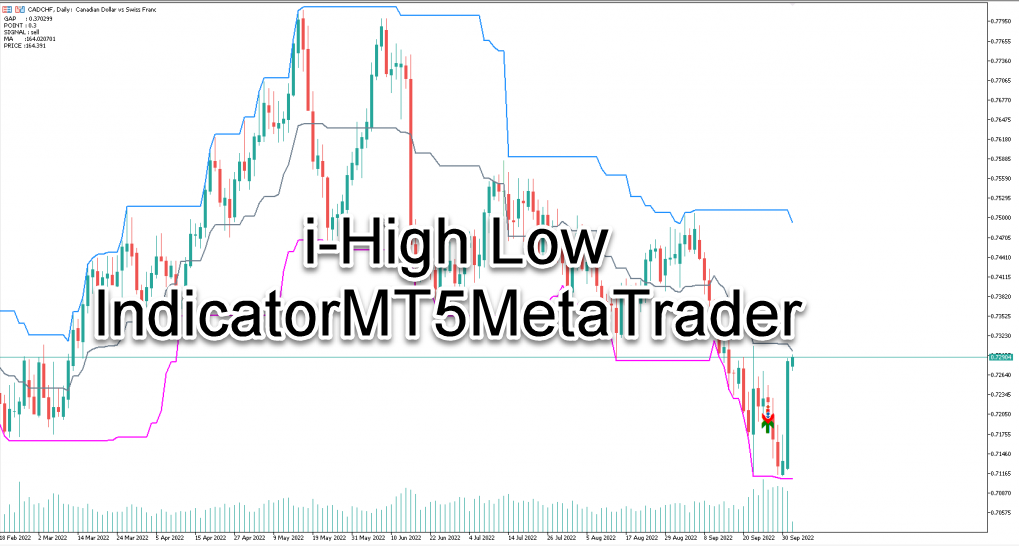

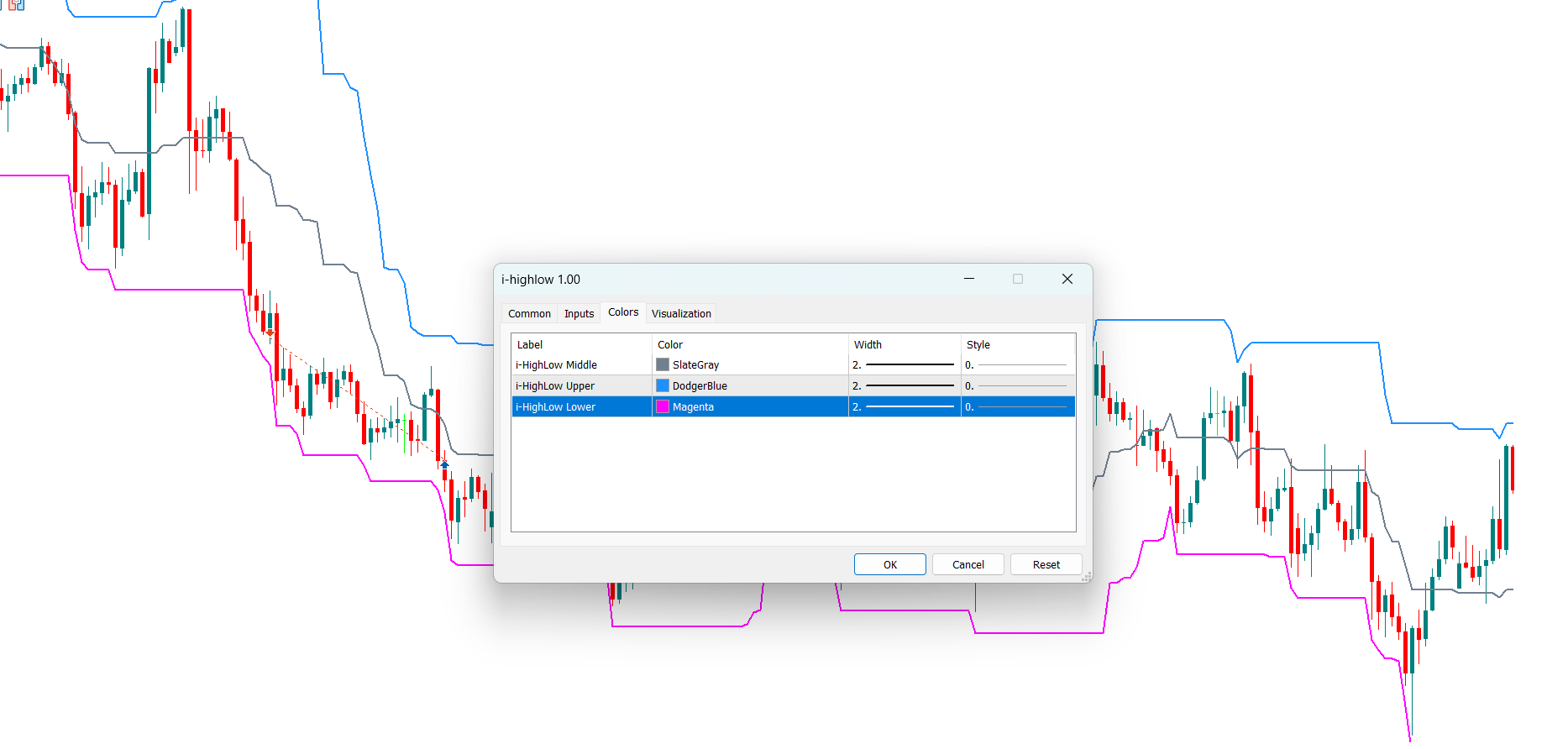

The i-High Low indicator is a cornerstone of technical analysis, especially for traders operating within the MetaTrader 5 (MT5) platform. It serves as a dynamic compass, guiding users through the often-turbulent waters of the market by pinpointing areas of potential support and resistance. Unlike static levels, the i-High Low dynamically adjusts to the ebbs and flows of price action, providing a more nuanced perspective on market movements. By skillfully plotting lines based on recent price candle highs and lows, the indicator constructs a trading channel – a visual representation that encapsulates the current market climate. This channel acts as a roadmap, assisting traders in crucial tasks like determining the prevailing trend, selecting optimal entry and exit points for their trades, and, perhaps most importantly, effectively managing the inherent risks associated with trading.To truly appreciate the power of the i-High Low, it’s essential to dissect its core components. The indicator’s functionality hinges on three primary lines, each serving a distinct purpose in constructing the overall trading channel:

1. The Upper Line: Dynamic Resistance Unveiled 🛡️

This line, often referred to as the dynamic resistance, is calculated by identifying the highest price achieved over the preceding 20 candles. To this peak price, a predefined offset of 50 pips is added. This offset acts as a buffer, accounting for minor price fluctuations and volatility. The resulting line paints a picture of potential resistance – a level where upward price movement may encounter significant selling pressure.Signaling Upward Trend Continuation:** A decisive break above the upper line holds considerable significance. It suggests that bullish momentum is strong enough to overcome the established resistance. This breakout could be a signal for traders to consider long positions, anticipating a continuation of the upward trend. The degree of confidence in this signal is often strengthened by the volume accompanying the breakout. A high-volume breakout signifies strong buying interest, bolstering the likelihood of sustained upward movement.

Premium TradingView account only $20 to buy, click here.

Click here to download and install i-High Low Indicator Indicator .

2. The Lower Line: Dynamic Support in the Spotlight 🔦

Mirroring the logic of the upper line, the lower line represents the dynamic support level. It’s determined by pinpointing the lowest price reached during the last 20 candles. This low is then reduced by a 50-pip offset. This offset, similar to the one used for the upper line, helps filter out insignificant price dips and market noise. The lower line, therefore, highlights a zone of potential support – a level where downward price movement may encounter significant buying interest.Indicating Potential Downward Trend Continuation:A breach below the lower line carries the opposite implication of an upper line breakout. It suggests that bearish forces are dominating, overpowering the existing support. This breakdown could prompt traders to consider short positions, anticipating a continuation of the downward trend. The strength of this signal is often validated by the volume accompanying the breakdown. High volume during a breakdown typically confirms strong selling pressure, increasing the probability of sustained downward movement

3.The Middle Line: Equilibrium and Potential Reversal Zones ⚖️

The middle line, often overlooked, serves as a crucial equilibrium point within the i-High Low channel. It’s calculated simply as the average of the upper and lower lines. While not acting as a hard support or resistance level in the same vein as the upper and lower lines, the middle line plays a significant role, particularly in volatile market conditions.Identifying Potential Reversal Areas: In choppy markets, where price oscillates rapidly between support and resistance, the middle line can serve as a barometer for potential reversals. Price action hovering around the middle line might suggest indecision or a potential shift in momentum. Traders often look for specific candlestick patterns, such as dojis or engulfing patterns, near the middle line to confirm a potential reversal. If a bullish candlestick pattern emerges near the middle line, it could indicate a shift towards upward momentum. Conversely, a bearish candlestick pattern near the middle line could signal a potential move downward.

Fine-Tuning the Indicator: Configuring for Optimal Performance ⚙️

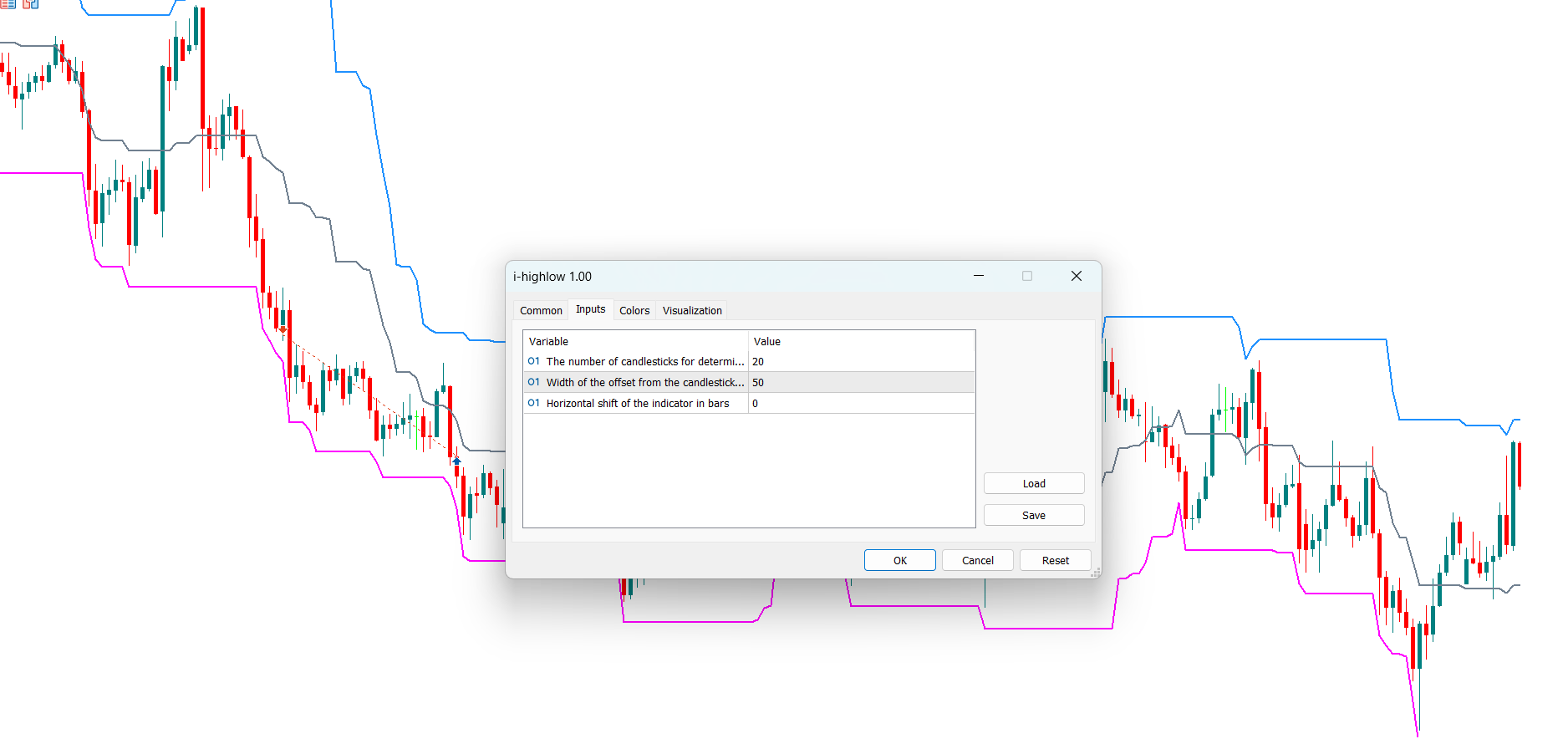

The beauty of the i-High Low indicator lies in its adaptability. Traders can fine-tune its behavior through three key configuration settings:

1. Number of Candles: The Timeframe Sensitivity ⏳

This setting dictates the number of preceding candles used to calculate the highest and lowest prices. The default value is typically set to 20, but this can be adjusted to suit individual trading styles and the specific timeframe being analyzed.Shorter Timeframes: When analyzing shorter timeframes, such as 5-minute or 15-minute charts, a smaller number of candles might be more appropriate. This allows the indicator to react more quickly to recent price changes. A value of 10 or 15, for example, would make the indicator more sensitive to short-term fluctuations.Longer Timeframes:Conversely, when working with longer timeframes, such as daily or weekly charts, a larger number of candles might provide a more accurate representation of the overall trend. A value of 30 or 40 could help filter out short-term noise and provide a clearer picture of the longer-term trend.

Click here to download and install i-High Low Indicator Indicator .

2. Deviation Width: Calibrating for Market Volatility 📈📉

This setting defines the offset, measured in pips, that is added to the highest price and subtracted from the lowest price when constructing the channel. The default value is typically 50 pips, but this can be adjusted based on the prevailing market volatility.High Volatility: In periods of high market volatility, a larger deviation width might be necessary to prevent the channel from being whipsawed by rapid price fluctuations. A value of 75 or 100 pips could provide a more stable representation of support and resistance levels.

Low Volatility: In contrast, when market volatility is low, a smaller deviation width might be more appropriate. This allows the indicator to be more sensitive to subtle price changes. A value of 25 or 30 pips could provide more precise support and resistance levels.

Click here to download and install i-High Low Indicator Indicator .

3. Horizontal Shift: Predictive Analysis and Backtesting ⏱️

This setting allows traders to shift the entire channel forward or backward in time. This seemingly simple feature unlocks powerful capabilities for predictive analysis and backtesting.Predictive Analysis: Shifting the channel forward allows traders to project potential future support and resistance levels based on past price action. This can be a valuable tool for planning future trades and anticipating potential market turning points.Backtesting:Shifting the channel backward allows traders to assess the indicator’s performance over historical data. This can help them determine the optimal settings for the indicator and refine their trading strategies.

Practical Applications: Leveraging the i-High Low in Trading

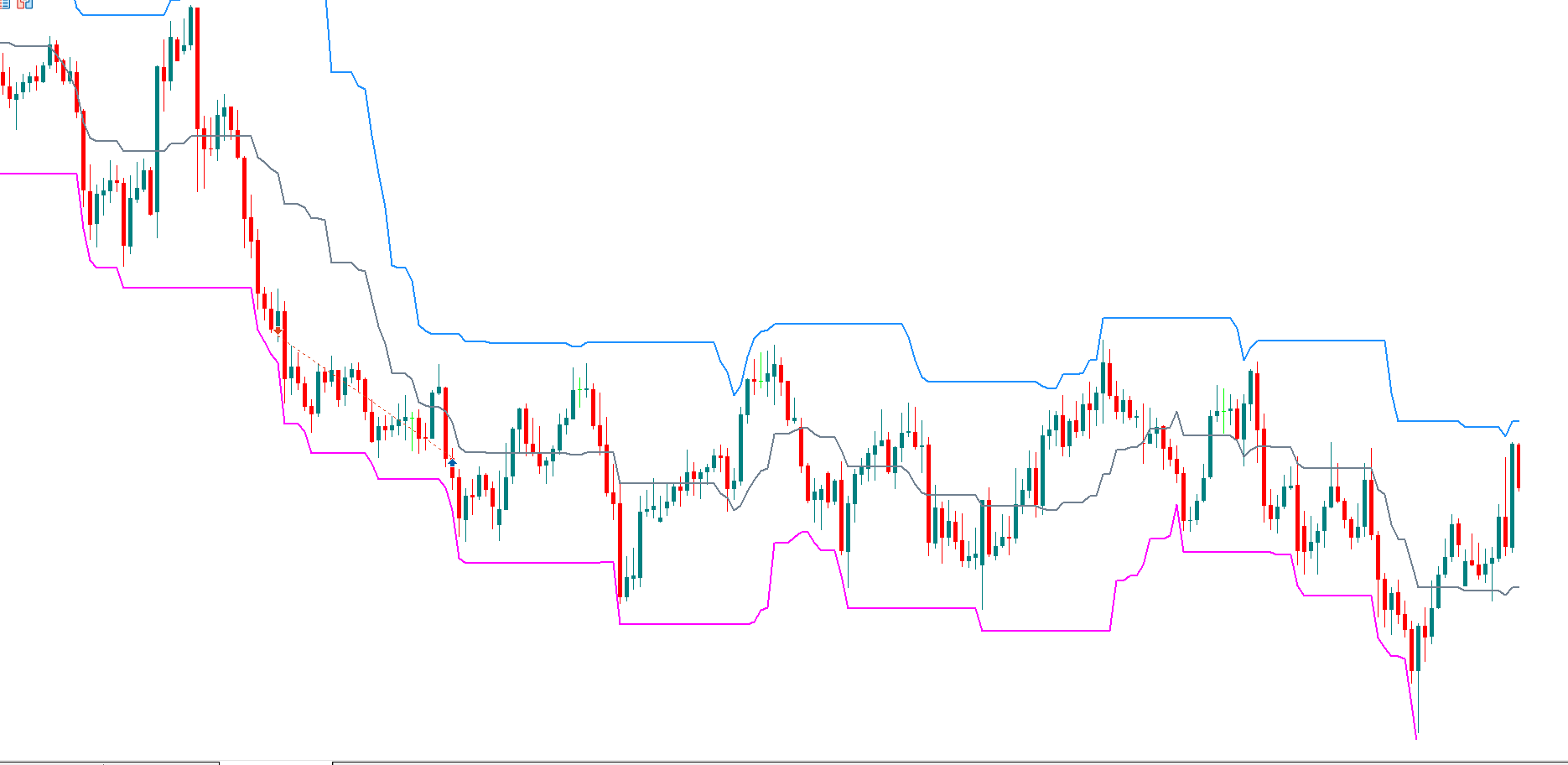

1. Trend Identification: Gauging the Market’s Direction 🧭

The indicator provides a clear visual representation of the prevailing trend.Uptrend:When the price is consistently trading in the upper half of the channel, it signals a general uptrend. The steeper the angle of the middle line, the stronger the uptrend is considered to be.

Downtrend: Conversely, when the price is consistently trading in the lower half of the channel, it suggests a downtrend. The steeper the downward angle of the middle line, the stronger the downtrend is deemed.

Sideways Trend:When the price is oscillating within the channel without a clear direction, and the middle line is relatively flat, it indicates a sideways or ranging market.

Click here to download and install i-High Low Indicator Indicator .

2.Support and Resistance Identification: Finding Key Price Levels 🎯

The upper and lower lines of the channel serve as dynamic support and resistance levels, respectively.Entry and Exit Points:Traders can use these levels to identify potential entry and exit points for their trades. For example, a trader might consider entering a long position when the price bounces off the lower line (support) and exiting the position when the price approaches the upper line (resistance).

Setting Take-Profit and Stop-Loss Orders:The support and resistance levels can also be used to set take-profit and stop-loss orders. A trader might place a take-profit order near the upper line (resistance) and a stop-loss order near the lower line (support).

3.Reversal Points: Spotting Potential Turning Tides 🔄

The middle line can be used to identify potential reversal points, particularly in volatile markets.Candlestick Pattern Confirmation:Traders often look for specific candlestick patterns near the middle line to confirm a potential reversal. A bullish candlestick pattern, such as a hammer or an engulfing pattern, could signal a potential move upward. Conversely, a bearish candlestick pattern, such as a hanging man or a dark cloud cover, could signal a potential move downward.

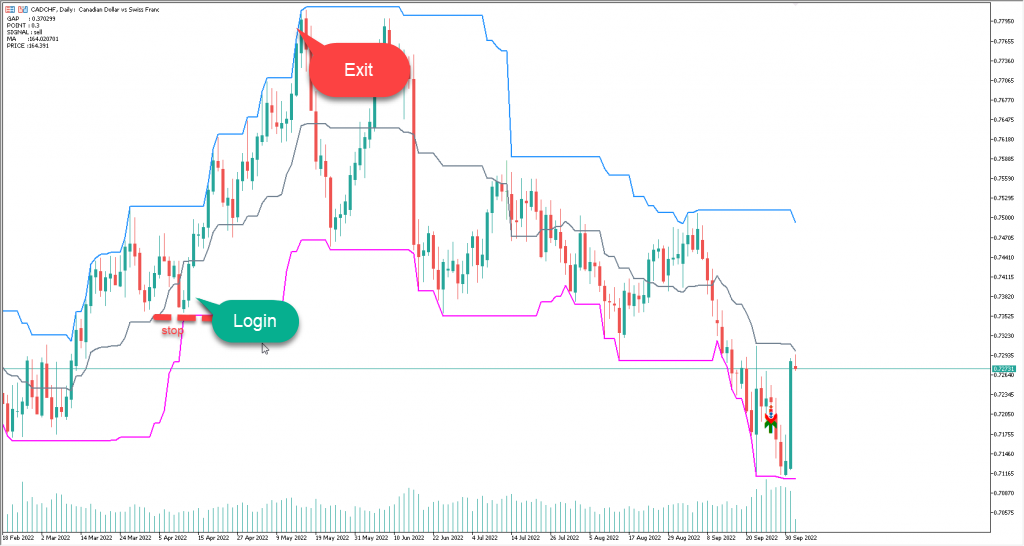

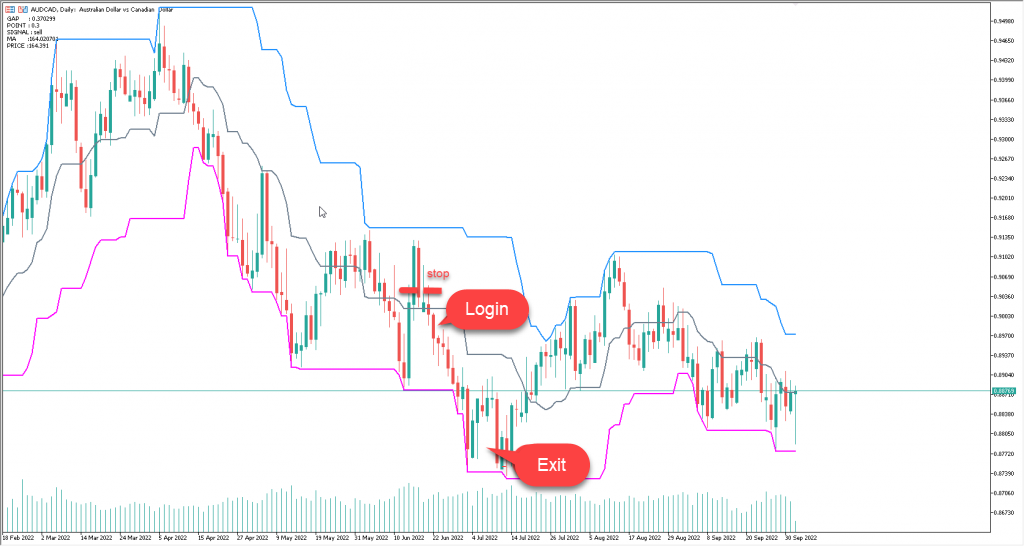

i-High Low Indicator Trading Strategies 💡

This strategy uses the i-High Low indicator to profit from both uptrends and downtrends. For uptrends, entry happens when the price is consistently in the upper channel half, retraces to the midline, and shows a bullish reversal. Exit is triggered by the price reaching the upper channel line or displaying bearish reversal signs. Downtrends are traded similarly, but with reversed conditions: entry on a retracement to the midline after a confirmed downtrend, exit on reaching the lower channel line or bullish reversal signals. Stop-loss orders are crucial for risk management in both scenarios.

Click here to download and install i-High Low Indicator Indicator .

Optimizing and Utilizing the i-High Low Indicator ✨

To maximize effectiveness, always verify i-High Low signals with other technical indicators. Remember its performance varies across timeframes; experiment to find optimal settings. Strict capital management is key; adjust trade sizes according to your risk tolerance. Continuously review and adapt your strategies based on market changes. Finally, remember that no indicator is infallible; integrate it into a comprehensive trading approach.

Weighing the Pros and Cons: A Balanced Perspective 🤔

Advantages of the i-High Low Indicator:Provides an easy-to-understand visual representation of dynamic support and resistance levels.Helps identify the prevailing trend in the market.Assists in selecting potential entry and exit points for trades. Offers guidance for setting stop-loss and take-profit orders.Disadvantages of the i-High Low Indicator: Can generate delayed signals due to its reliance on past price data. Susceptible to generating false signals, particularly in volatile markets.Requires confirmation from other technical analysis tools.

Mastering the i-High Low for Enhanced Trading 🚀

The i-High Low indicator is a powerful tool for MT5 traders, offering valuable insights into dynamic support and resistance levels, trend identification, and potential reversal points. By mastering its functionality, understanding its configuration settings, and using it in conjunction with other analysis techniques, traders can enhance their trading decisions and improve their overall profitability. Remember to always prioritize sound capital management practices and to continuously refine your trading strategies based on market conditions and your own trading experience. The journey to becoming a successful trader is a continuous process of learning, adaptation, and refinement.

Post Comment